Your Guide to Finding the Perfect Storage Unit in Austin, Texas

Austin, Texas, a vibrant city known for its live music scene, thriving tech industry, and unique culture, also boasts a bustling storage unit market. Whether you’re a student decluttering before moving, a homeowner renovating, or a business owner needing extra space, finding the right storage unit in Austin can be a crucial step. This comprehensive guide navigates the complexities of the Austin storage landscape, providing insights into different unit types, pricing structures, location considerations, and essential tips for a smooth storage experience.

Understanding Austin’s Storage Unit Landscape

Austin’s storage unit market is diverse, catering to a wide range of needs and budgets. You’ll encounter various facility sizes, from small, family-owned operations to large, national chains. Understanding the differences between these facilities is vital for making an informed decision. Factors such as security measures, amenities, and customer service vary significantly.

- Climate-Controlled Units: These units maintain a consistent temperature and humidity, protecting sensitive items like furniture, electronics, and artwork from damage caused by extreme weather conditions. Austin’s climate can fluctuate dramatically, making climate-controlled units a worthwhile investment for many.

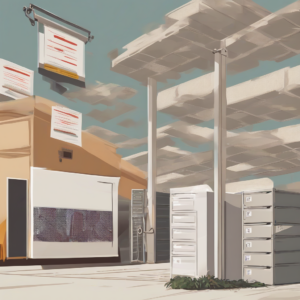

- Drive-Up Units: Offering easy access directly from your vehicle, drive-up units are ideal for loading and unloading larger or heavier items. This convenience is particularly helpful for those moving or storing bulky furniture.

- Indoor Units: Providing greater protection from the elements compared to outdoor units, indoor units are a popular choice for securing valuables and sensitive belongings.

- Outdoor Units: Typically more affordable, outdoor units are suitable for storing less sensitive items that can withstand exposure to the elements. However, careful consideration of weather conditions is essential.

- Vehicle Storage: Some facilities offer spaces for storing cars, boats, RVs, and other vehicles. These spaces often come with added security measures.

Factors to Consider When Choosing a Storage Unit in Austin

Selecting the perfect storage unit involves several key considerations beyond simply unit size and price. Careful planning ensures a stress-free experience and protects your belongings.

- Location: Convenience is key. Choose a facility that’s easily accessible and close to your home or business. Consider factors like traffic patterns and proximity to public transportation.

- Security: Look for facilities with robust security features, including gated access, video surveillance, and on-site management. Inquire about insurance options to further protect your belongings.

- Size and Type of Unit: Accurately assess your storage needs. Measure your belongings to determine the appropriate unit size. Consider whether you need climate control or drive-up access.

- Pricing and Contract Terms: Compare prices from multiple facilities, paying attention to any hidden fees or contract terms. Understand the rental agreement thoroughly before signing.

- Accessibility and Hours of Operation: Ensure the facility offers convenient access hours that align with your schedule. Consider 24/7 access options if needed.

- Reputation and Reviews: Research the facility’s reputation by reading online reviews and checking with the Better Business Bureau. Look for consistent positive feedback from previous customers.

- Insurance Options: Many facilities offer insurance options to cover your stored belongings in case of damage or loss. Evaluate whether this additional coverage is necessary for your specific needs.

- Packing Supplies: Some facilities sell packing supplies, offering convenience and potentially saving you time and effort. Inquire about availability and pricing.

Navigating the Austin Storage Market: Tips and Strategies

The Austin storage market can be competitive, so a strategic approach is vital. These tips will help you find the best unit at the best price.

- Compare Prices: Don’t settle for the first quote you receive. Compare prices and features from multiple facilities to ensure you’re getting the best value.

- Negotiate Rates: Don’t hesitate to negotiate the rental rate, particularly if you’re committing to a long-term lease. Mention competing offers to strengthen your negotiating position.

- Read Reviews: Online reviews offer valuable insights into a facility’s reputation, customer service, and security measures. Pay attention to both positive and negative feedback.

- Visit Facilities in Person: Whenever possible, visit the facilities you’re considering in person. This allows you to assess the cleanliness, security, and overall condition of the facility.

- Ask Questions: Don’t hesitate to ask questions about the facility’s policies, security measures, and insurance options. A knowledgeable staff can address your concerns and help you make an informed decision.

- Understand Contract Terms: Read the rental agreement carefully before signing. Pay close attention to the terms of the contract, including the length of the lease, renewal options, and early termination fees.

- Consider Seasonal Rates: Storage rates may fluctuate depending on the season. Inquire about seasonal discounts or promotions that could save you money.

- Plan Ahead: Start your search early, especially during peak moving seasons. This gives you more time to compare options and secure the best unit for your needs.

Popular Austin Storage Unit Locations

Austin’s diverse neighborhoods offer a variety of storage options, each with its own advantages. Consider proximity to your home or workplace and the overall character of the area.

- Downtown Austin: While often more expensive, downtown storage provides easy access to the city center. This is ideal for businesses and individuals needing central location.

- North Austin: A rapidly growing area, North Austin offers a wider range of options and potentially more competitive pricing compared to the downtown core.

- South Austin: Known for its vibrant culture and diverse population, South Austin also offers a variety of storage solutions catering to different needs and budgets.

- East Austin: This up-and-coming area features a mix of residential and commercial properties, providing storage solutions for both individuals and businesses.

- West Austin: A more affluent area, West Austin offers a range of storage options, although pricing might be higher compared to other areas.

Types of Items Commonly Stored

Understanding what types of items are commonly stored can help you better assess your own needs and choose the right unit size and type.

- Furniture: Sofas, chairs, tables, beds, and other large furniture pieces are frequently stored, especially during moves or renovations.

- Electronics: Televisions, computers, gaming consoles, and other sensitive electronics require climate-controlled storage to prevent damage.

- Artwork and Collectibles: Valuable artwork and collectibles need secure, climate-controlled storage to protect them from damage and theft.

- Documents and Records: Important documents and business records should be stored in a secure and climate-controlled environment.

- Seasonal Items: Holiday decorations, sporting equipment, and other seasonal items are commonly stored to free up space in homes and garages.

- Business Inventory: Businesses of all sizes utilize storage units to manage inventory, freeing up valuable space in their offices or retail locations.

- Moving Supplies: Boxes, packing tape, bubble wrap, and other moving supplies can be conveniently stored before, during, or after a move.

Finding the Right Storage Solution in Austin: A Final Thought

Finding the perfect storage unit in Austin requires careful planning, research, and comparison. By considering the factors outlined in this guide, you can navigate the market effectively and choose a storage solution that meets your needs and budget. Remember, taking the time to assess your requirements, compare options thoroughly, and read reviews will ultimately lead to a successful and stress-free storage experience.